EMI Calculator

Repayment Summary

Yearly Amortization Schedule

| Year | Principal Paid | Interest Paid | Balance |

|---|

Advanced EMI Calculator: Free Home, Car & Personal Loan Tool

Taking out a loan is one of the biggest financial commitments you will make in your life. Whether you are buying your dream home, driving off in a new car, or taking a personal loan for an emergency, the most critical question remains the same: “How much will I have to pay every month?”

This is where the CalculatorAll.in the Advanced EMI Calculator becomes your essential financial companion.

Gone are the days of manual calculations and confusing Excel sheets. Our intelligent online tool helps you calculate your Equated Monthly Instalment (EMI) instantly. With features like dynamic sliders, visual graphs, and a detailed amortisation schedule, planning your financial future has never been easier.

What is an Equated Monthly Installment (EMI)?

An Equated Monthly Instalment (EMI) is a fixed amount of money that you pay to a bank or lender on a specific date each month. It is used to pay off both the interest and the principal amount of a loan over a specified period (tenure).

An EMI consists of two distinct components:

- Principal Component: The portion of your payment that reduces the actual loan balance.

- Interest Component: The cost you pay to the lender for borrowing the money.

In the early years of your loan, a large chunk of your EMI goes toward interest. As the tenure progresses, the interest portion decreases, and the principal repayment increases. Our calculator visualizes this shift perfectly.

How to Use Our Advanced EMI Calculator

We have designed the CalculatorAll.in interface to be intuitive, responsive, and mobile-friendly. You don’t need to be a math genius to use it. Just follow these three simple steps:

- Enter Loan Amount: Input the total amount you wish to borrow. You can type the figure or use the slider to adjust it.

- Set Interest Rate: Enter the annual interest rate offered by your bank. (e.g., 8.5% for home loans or 11% for personal loans).

- Choose Tenure: Select the number of years you need to repay the loan.

Once you input these details, our tool instantly calculates your monthly EMI, total interest payable, and the total amount you will pay by the end of the tenure.

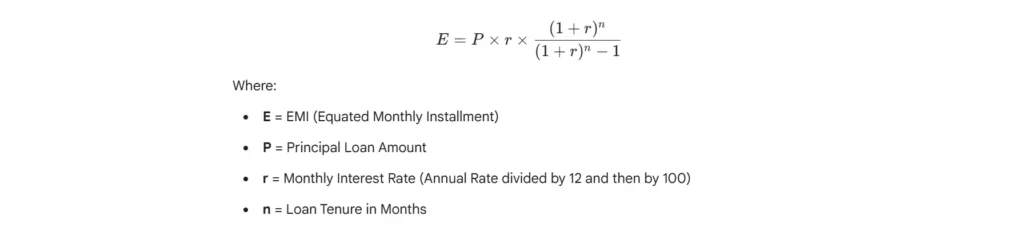

The EMI Calculation Formula Explained

While our tool handles the complex math in milliseconds, understanding the formula behind it helps you see how banks calculate your dues.

See the mathematical formula for EMI calculation in the image below:

Why Manual Calculation is Difficult

As you can see, the formula involves exponential calculations. A small error in decimals can lead to a massive difference in the final result. That is why financial experts recommend using a verified digital tool like the CalculatorAll.in the EMI Calculator to ensure 100% accuracy.

Factors That Impact Your Monthly EMI

Your EMI isn’t just a random number; it is influenced by three primary levers. Adjusting any one of these in our calculator will change your monthly burden.

1. The Loan Amount (Principal)

This is straightforward: the more you borrow, the higher your EMI.

- Tip: Use our tool to find a “sweet spot” loan amount that fits your monthly budget without stretching your finances too thin.

2. The Interest Rate

Interest rates vary based on the type of loan and your credit score.

- Floating Rate: Changes with market trends (common for home loans).

- Fixed Rate: Remains the same throughout the tenure. Even a 0.5% difference in interest rate can save you lakhs of rupees over 20 years.

3. The Loan Tenure

This is the most critical factor for monthly budgeting.

- Long Tenure: Lowers your monthly EMI but increases the Total Interest you pay.

- Short Tenure: Increases your monthly EMI but significantly reduces the Total Interest cost.

- Strategy: Use the “Amortisation Schedule” feature below our calculator to compare a 15-year tenure vs. a 20-year tenure.

EMI Calculator for Different Loan Types

Our universal tool is versatile enough to handle calculations for various financial products.

Home Loan EMI Calculator

Home loans usually involve high principal amounts and long tenures (15 to 30 years). Since the tenure is long, the interest component is massive. Our tool helps you decide if you should prepay part of your loan to save on interest.

Car Loan EMI Calculator

Car loans are typically shorter (3 to 7 years). Since cars are depreciating assets, it is wise to opt for a shorter tenure to close the loan quickly. Our calculator allows you to test 3-year vs. 5-year scenarios instantly.

Personal Loan EMI Calculator

Personal loans carry higher interest rates (10% to 24%). It is crucial to check the EMI before applying, as high interest can disrupt your monthly cash flow.

Understanding the Amortization Schedule

One of the unique features of the CalculatorAll.in tool is the Yearly Amortization Schedule.

Most borrowers are shocked to learn that in the first few years of a long-term loan, they are barely paying off the principal. The amortization table breaks this down year by year, showing you exactly how much of your money went to the bank as profit (interest) and how much actually reduced your debt.

Why is this important? If you plan to foreclose (pay off) your loan early, looking at this schedule helps you decide the right time. Typically, prepaying early in the tenure yields the most savings.

Real-World EMI Calculation Examples

Let’s look at two practical scenarios to understand how the calculator works.

Case Study 1: The Home Buyer

Mr Sharma takes a Home Loan of ₹50,00,000 at 8.5% interest for 20 years.

- Monthly EMI: ₹43,391

- Total Interest Payable: ₹54,13,879

- Total Payment: ₹1,04,13,879

- Insight: Mr Sharma pays more in interest (₹54 Lakhs) than the loan amount itself! He can see this clearly in our tool’s “Red vs. Green” doughnut chart.

Case Study 2: The Car Buyer

Ms Priya takes a Car Loan of ₹10,00,000 at 9% interest for 5 years.

- Monthly EMI: ₹20,758

- Total Interest Payable: ₹2,45,501

- Total Payment: ₹12,45,501

- Insight: Because the tenure is short, the interest burden is much lower compared to the principal.

Why Choose CalculatorAll.in EMI Calcultor ?

There are thousands of calculators on the internet. Why should you trust ours?

- Visual Breakdown: We don’t just give you numbers. Our interactive charts visualise the ratio between your Principal and Interest.

- Smart Suggestions: Our algorithm analyses your input. If your interest rate is suspiciously high (>15%), the tool alerts you. If your interest burden is too high, it suggests reducing the tenure.

- Detailed Reports: The responsive breakdown table offers a transparent view of your loan’s lifecycle.

- Privacy First: All calculations happen in your browser. We do not store your financial data.

- 100% Free: No hidden costs, no signup required.

Frequently Asked Questions (FAQ)

Yes, this calculator works perfectly for mortgages, housing loans, and property loans.

No, this tool calculates the pure EMI based on principal and interest. Processing fees and insurance are usually one-time upfront costs and are not part of the monthly installment.

You can reduce your EMI by making a larger down payment (reducing the principal), negotiating a lower interest rate with your lender, or extending your loan tenure (though this increases total interest cost).

The calculator uses the standardised banking formula for accuracy. However, some banks may have specific methods for calculating interest during the “moratorium period” or may add taxes, so slight variations can occur.

Take Control of Your Loans Today

Financial planning shouldn’t be a guessing game. Before you sign those loan documents, use the CalculatorAll.in Advanced EMI Calculator to know exactly what you are getting into.

Adjust the sliders, analyse the charts, and find the EMI that fits your pocket perfectly. Start calculating now!