FD Calculator

Invested Amount

Total Interest

Maturity Value

Absolute Return

Yearly Breakdown

| Year | Opening Balance | Interest Earned | Closing Balance |

|---|

FD Calculator: The Ultimate Tool to Calculate Fixed Deposit Returns

In the world of investing, trends come and go, but the Fixed Deposit (FD) remains the undisputed king of safety. For generations, Indians have trusted FDs to safeguard their hard-earned money against market volatility while earning a guaranteed return.

However, calculating the exact maturity value of an FD is not as simple as it seems. Banks use complex compound interest formulas, often compounding quarterly, which can make manual calculations confusing.

Welcome to CalculatorAll.in. Our Advanced FD Calculator is engineered to provide precise maturity estimates. Unlike basic tools, our calculator allows you to adjust the compounding frequency—from monthly to yearly—giving you the most accurate picture of your wealth growth.

What is a Fixed Deposit (FD) Calculator?

A Fixed Deposit Calculator is a digital financial tool that helps investors determine the maturity amount and total interest they will earn on their deposit after a specific tenure.

When you open an FD, you lock a lump sum amount for a fixed period at a pre-determined interest rate. While the concept is simple, the math involves compound interest, meaning you earn interest on your principal plus the interest previously earned.

Our tool on CalculatorAll.in eliminates the need for manual spreadsheets. It considers your principal, tenure, interest rate, and compounding frequency to give you an instant result.

How to Use the Advanced FD Calculator

Our calculator is designed for flexibility. Whether you are checking rates for SBI, HDFC, ICICI, or a Post Office FD, our tool works for all.

1. Enter Total Investment

Input the lump sum amount you plan to deposit. The minimum can be as low as ₹5,000.

2. Set the Interest Rate

Enter the annual interest rate offered by your bank.

- General Citizens: Typically 6.5% – 7.5%

- Senior Citizens: Typically 0.50% higher (7% – 8%)

3. Choose Time Period

Select the tenure of your deposit. FDs can range from 7 days to 10 years.

4. Select Compounding Frequency (Pro Feature)

This is what makes the CalculatorAll.in tool special. Most calculators assume yearly compounding. However, Indian banks typically compound interest Quarterly.

- Standard: Quarterly (Most Banks)

- High Yield: Monthly (Some Corporate FDs)

- Simple: Yearly

Once entered, you will see a dynamic Doughnut Chart visualising your “Invested Amount” vs. “Total Interest” and a detailed Yearly Breakdown Table.

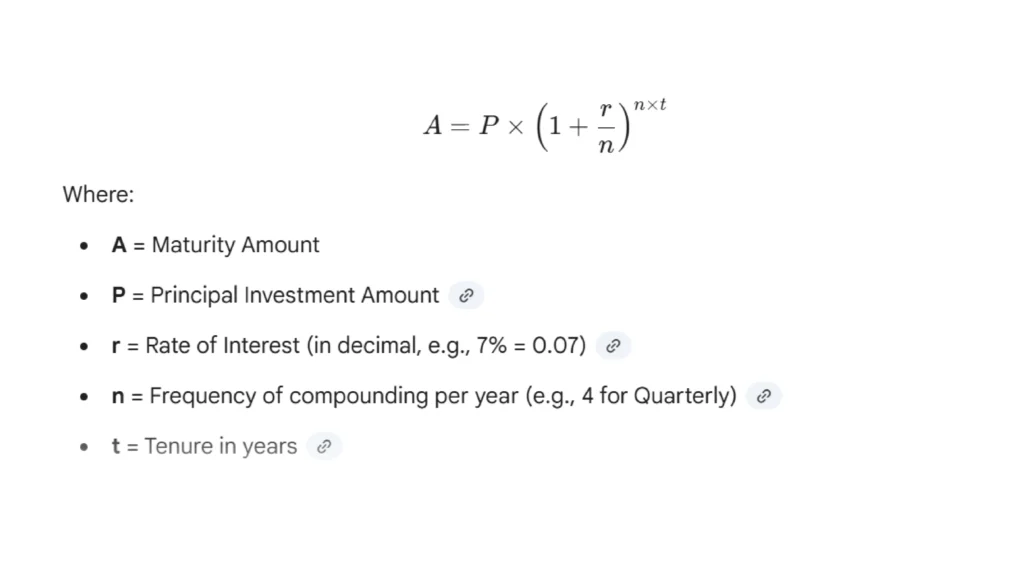

FD Calculator Formula: The Math Behind the Maturity

Curious about how banks calculate your returns? It is governed by the universal compound interest formula.

See the formula used in the image below:

Why "n" Matters (The Power of Quarterly Compounding)

If you invest ₹1 Lakh at 10% for 1 year:

- Simple Interest: You earn ₹10,000.

- Quarterly Compounding (n=4): You earn ₹10,381

- Difference: You earn an extra ₹381 just because of compounding!

Real-Life FD Calculation Examples

Let’s examine two scenarios to see how tenure and compounding impact your returns.

Scenario A: The Safety Net (5 Years)

Priya invests ₹5 Lakhs in a tax-saving FD for 5 years at 7% interest (Compounded Quarterly).

- Invested: ₹5,00,000

- Maturity Value: ₹7,07,389

- Profit: ₹2.07 Lakhs

- Verdict: A risk-free growth of over 40% on her capital.

Scenario B: The Senior Citizen (1 Year)

Mr. Sharma (65 years old) invests ₹10 Lakhs for 1 year at a special rate of 7.5%.

- Invested: ₹10,00,000

- Maturity Value: ₹10,77,136

- Profit: ₹77,136

- Verdict: A guaranteed income stream without worrying about stock market crashes.

FD vs. Other Savings Options

Is a fixed deposit the right option for you? Let’s compare it with other popular instruments, see the image below:

Pro Tip: If you want to invest monthly instead of a lump sum, use our SIP Calculator or RD Calculator.

Benefits of Investing in Fixed Deposits

- Guaranteed Returns: Unlike stocks or mutual funds, you know exactly how much you will get at maturity.

- Flexible Tenure: You can park money for as little as 7 days or as long as 10 years.

- Loan Against FD: In emergencies, you can take a loan of up to 90% of your FD value at a lower interest rate (usually 1-2% higher than the FD rate) without breaking the deposit.

- Senior Citizen Benefits: Seniors usually get 0.50% to 0.75% extra interest, making it an excellent source of retirement income.

Frequently Asked Questions (FAQs)

Small Finance Banks generally offer higher rates (up to 8-9%) compared to large public sector banks (SBI, PNB) or private banks (HDFC, ICICI). However, always check the bank’s credibility.

Yes. Most banks charge a penalty of 0.5% to 1% on the interest rate if you close the FD before maturity.

Our tool defaults to Quarterly compounding, which is the standard for 99% of Indian banks. However, you can use the “Compounding Frequency” slider to switch to Monthly or Yearly calculations for specific schemes.

A Tax-Saving FD has a mandatory lock-in of 5 years. The principal amount (up to ₹1.5 Lakhs) allows for a tax deduction under Section 80C.

No. An FD is a one-time contract. If you have more money to invest later, you must open