Interest Calculator

Result Summary

Free Advanced Interest Calculator: Simple & Compound Interest Online

Money has a potential that often goes untapped. Whether you are planning a long-term investment, taking out a loan, or simply saving for a rainy day, understanding how your money grows is crucial. This is where a reliable interest calculator becomes your most valuable financial tool.

At CalculatorAll.in, we have developed a highly advanced, free online tool designed to help you visualise your financial future. Whether you need to calculate flat returns or see the magic of compounding, our tool provides instant, accurate results with detailed yearly breakdowns.

What is an Interest Calculator?

An interest calculator is a digital tool that automates the complex mathematical formulas used to determine the return on an investment or the cost of a loan. Instead of manually crunching numbers, you simply input your principal amount, interest rate, and time period.

Our tool at CalculatorAll.in goes a step further. It isn’t just a basic calculator; it is a dual-engine system that handles both Simple Interest and Compound Interest. It helps investors, students, and financial planners answer the most important question: “How much will my money be worth in the future?”

Simple vs. Compound Interest: The Key Differences

To make the best financial decisions, you must understand the two main types of interest. Our calculator allows you to toggle between these two modes instantly.

1. Simple Interest (The Flat Growth)

Simple interest is calculated only on the principal amount (the original sum of money). It does not take into account any interest that has accumulated over time.

- Best for: Short-term loans, car loans, and some basic savings accounts.

- Behavior: The growth is linear and consistent. You earn the exact same amount of interest every year.

2. Compound Interest (The Snowball Effect)

Compound interest is often called the “eighth wonder of the world.” Here, you earn interest on your principal plus the interest you have already earned.

- Best for: Mutual funds, stocks, long-term Fixed Deposits (FDs), and retirement planning.

- Behaviour: The growth is exponential. Your money grows faster as time goes on because your interest earns interest.”

How to Use Our Interest Calculator

We have designed our interface to be intuitive and responsive. Follow these simple steps to get a detailed analysis of your finances:

- Enter Principal Amount: Input the initial amount of money you are investing or borrowing. You can type the number or use the smooth slider.

- Set Annual Interest Rate: Enter the expected rate of return (e.g., 7% for a bank FD or 12% for mutual funds).

- Select Time Period: Choose how many years you want to stay invested.

- Choose Interest Type: Select “Simple Interest” or “Compound Interest” from the dropdown menu.

- Pro Tip: If you select Compound Interest, a new field for “Compounding Frequency” will appear. You can choose Annual, Semi-Annual, Quarterly, or Monthly compounding to see how frequency affects your returns.

- View Results: Instantly see your Total Value, Interest Earned, and a visual Doughnut Chart.

- Analyze the Breakdown: Scroll down to the “Detailed Breakdown” section to see a period-by-period table of how your balance grows

The Mathematics: Interest Formulas Explained

While our tool handles the heavy lifting, understanding the formulas can help you grasp the mechanics of finance.

The Mathematics: Interest Formulas Explained

While our tool handles the heavy lifting, understanding the formulas can help you grasp the mechanics of finance.

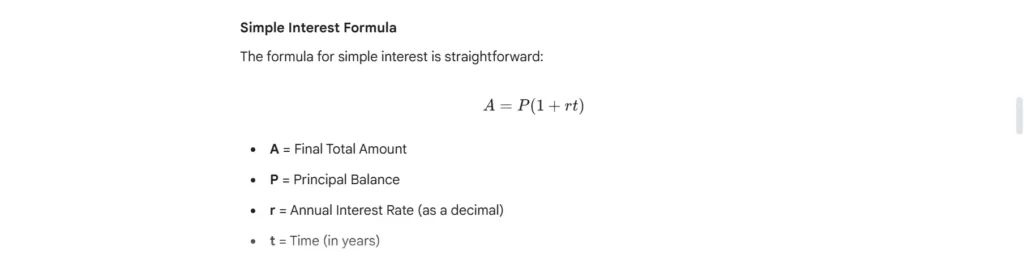

See the Simple Interest Formula in the image below

The formula for simple interest is straightforward:

Simple Interest Formula

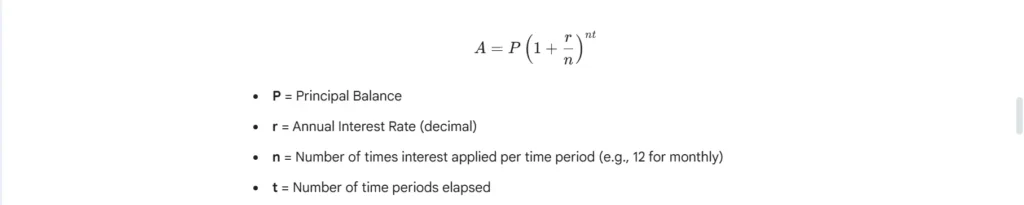

Compound Interest Formula

The formula for compound interest includes the frequency of compounding, making it slightly more complex:

Real-World Examples of Interest Calculation

Let’s look at a practical example to demonstrate why choosing the right investment method matters.

Scenario: You invest ₹1,00,000 for 10 years at an interest rate of 10%.

Case A: Using Simple Interest

If you put this money in a scheme yielding simple interest:

- Annual Interest: ₹10,000

- Total Interest over 10 Years: ₹1,00,000

- Final Value: ₹2,00,000

- Result: Your money doubled.

Case B: Using Compound Interest (Annually)

If you invest the same amount in a compounding scheme:

- Year 1 Interest: ₹10,000 (Same as simple)

- Year 5 Interest: ₹14,641 (Interest is growing)

- Total Interest over 10 Years: ₹1,59,374

- Final Value: ₹2,59,374

- Result: You earned an extra ₹59,374 just by utilising the power of compounding!

You can replicate this exact scenario in the CalculatorAll.in tool above to verify these numbers

Factors That Affect Your Returns

When using our interest calculator, you will notice that small changes in inputs can lead to massive differences in the final output. Here are the three pillars of investment growth:

1. Time (The Long Game)

Time is the most significant factor in compounding. Investing for 20 years yields significantly more than investing for 10 years, not just because you save longer, but because the compounding curve becomes steeper in later years.

2. Rate of Return

A difference of just 1% or 2% might seem negligible, but over 15-20 years, it can mean a difference of lakhs or even crores. Use our slider to adjust the rate and see the impact instantly.

3. Compounding Frequency

How often is interest added to your account?

- Annually: Interest is added once a year.

- Quarterly: Interest added every 3 months.

- Monthly: Interest added every month.

- Rule of Thumb: The more frequent the compounding, the higher the final return.

Why Choose Our Advanced Interest Calculator?

With hundreds of calculators available on the web, why should you bookmark CalculatorAll.in?

- Detailed Breakdown Table: Unlike basic calculators that just show a final number, we provide a responsive table showing your growth year-by-year or month-by-month.

- Visual Graphs: Our interactive doughnut chart helps you visualise the ratio between your principal amount and the interest earned.

- Smart Suggestions: Our tool analyses your inputs and offers dynamic financial tips—alerting you if an interest rate looks too risky or praising you for long-term discipline.

- Mobile Optimised: Whether you are on a smartphone, tablet, or desktop, the calculation card adjusts perfectly to your screen.

- 100% Free: No hidden fees, no sign-ups required.

Frequently Asked Questions (FAQ)

Yes. While primarily designed for investments, the Simple Interest mode accurately calculates interest payable on standard personal loans. For mortgages, we recommend using a specialised EMI calculator.

For an investor, Monthly compounding is better. Since interest is added to your principal 12 times a year, your money grows faster compared to annual compounding.

The mathematical formulas used are precise. However, real-world returns can be affected by tax deductions (TDS) and inflation, which this calculator does not currently deduct from the total.

Start Calculating Your Wealth Today

Financial freedom begins with understanding your numbers. Don’t guess your future—calculate it. Scroll up to the CalculatorAll.in the Advanced Interest Calculator, input your savings goals, and discover how powerful your money can truly be.

Try Other Useful Calculators