Lumpsum Calculator

Invested Amount

Est. Returns

Total Value

Absolute Return

Yearly Breakdown

| Year | Invested Amount | Interest Earned | Maturity Value |

|---|

Lumpsum Calculator: Unlock the Power of One-Time Investing

Have you received a yearly bonus, sold an asset, or inherited a sum of money? Leaving a large amount of cash in a savings account is often a financial mistake. Inflation eats away at your purchasing power, meaning your money loses value every day it sits idle.

The solution? Lumpsum Investing.

Welcome to CalculatorAll.in. Our advanced Lumpsum Calculator is designed to help you visualise how a single, one-time investment can grow into a massive corpus over time through the power of compounding. Whether you are planning to invest in Mutual Funds, Fixed Deposits, or Stocks, our tool gives you accurate projections instantly.

What is a Lumpsum Calculator?

A Lumpsum Calculator is a digital simulation tool that computes the future value of a one-time investment at a specific rate of return over a defined period.

Unlike a Systematic Investment Plan (SIP), where you invest small amounts monthly, a Lumpsum investment involves deploying a large amount of capital all at once. Because the entire amount starts earning interest from Day 1, the potential for wealth creation through compounding is significantly higher in the long run.

Our tool on CalculatorAll.in simplifies complex financial math. You do not need to be a chartered accountant to understand your returns—just input your numbers, and let the calculator do the work.

How to Use Our Lumpsum Calculator

Using our tool is straightforward. It allows you to toggle variables to see different financial scenarios. Here is how to navigate it:

1. Enter Total Investment

Input the lump sum amount you wish to invest. This could be ₹50,000, ₹5 Lakhs, or even ₹1 Crore.

2. Set Expected Return (%)

Enter the annual interest rate or CAGR (Compound Annual Growth Rate) you expect.

- Fixed Deposits: ~6.5% – 7.5%

- Debt Mutual Funds: ~7% – 9%

- Equity Mutual Funds: ~12% – 15% (Long Term)

3. Choose Time Period

Select the duration (in years) for which you are willing to lock in your money. The longer you stay invested, the more powerful the compounding effect becomes.

Once you enter these details, the calculator generates a Visual Doughnut Chart showing your “Invested Amount” vs. “Estimated Returns” and a detailed Yearly Breakdown Table.

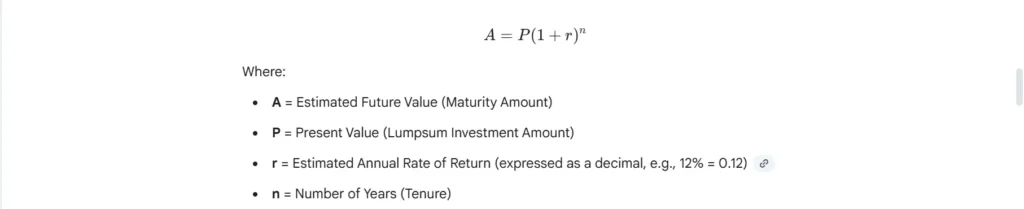

The Lumpsum Calculator Formula

How do we arrive at the maturity value? The calculation is based on the compound interest formula used by financial institutions globally.

see the formula in the image below:

Note: This formula assumes annual compounding, which is the standard method for calculating CAGR in mutual funds.

Lumpsum Investment Examples

To understand the impact of time and returns, let’s look at two practical scenarios.

Scenario 1: The Short-Term Parker

Amit receives a bonus of ₹5 Lakhs. He invests it in a conservative Debt Fund for 5 years at an expected return of 8%.

- Invested: ₹5,00,000

- Maturity Value: ₹7.34 Lakhs

- Profit: ₹2.34 Lakhs

Scenario 2: The Long-Term Wealth Builder

Sara inherits ₹5 Lakhs. She invests it in a diversified Equity Mutual Fund for 20 years at an expected return of 12%.

- Invested: ₹5,00,000

- Maturity Value: ₹48.23 Lakhs

- Profit: ₹43.23 Lakhs

The Insight: Both invested the same amount. However, by staying invested for 15 extra years at a higher rate, Sara’s money grew nearly 10 times, whereas Amit’s money grew 1.5 times. This illustrates why using the CalculatorAll.in Lumpsum Calculator to plan for the long term is essential.

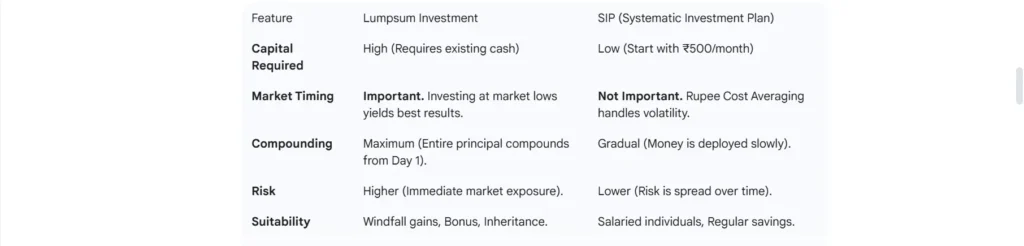

Lumpsum vs. SIP: Which is Better?

This is the most common debate in the investment world. Should you invest everything now (Lumpsum) or stagger it (SIP)?

derstand from the image below

Pro Tip: If you have a large sum but are afraid of market volatility, consider an STP (Systematic Transfer Plan). You invest the lumpsum in a liquid fund and transfer small amounts weekly/monthly to an equity fund.

Where Can You Invest a Lumpsum Amount?

When you have a large corpus, you have several avenues. Our calculator can be used for any instrument that offers compound growth:

1. Equity Mutual Funds

High risk, high reward. Historically, these have delivered 12-15% returns over 10+ years. Best for goals like retirement or children’s education.

2. Debt Mutual Funds

Moderate risk, moderate reward. Good for 3-5 year horizons. They generally beat bank Fixed Deposit returns due to indexation benefits (though tax rules have recently changed).

3. Public Provident Fund (PPF)

A government-backed scheme with a lock-in of 15 years. You can invest a lumpsum of up to ₹1.5 Lakhs annually. It offers tax-free returns.

4. Fixed Deposits (FD)

The safest option, but with the lowest post-tax returns. Use this for emergency funds, not for wealth creation.

Taxation on Lumpsum Investments (2025 Update)

Before withdrawing your money, you must account for taxes. The “Estimated Returns” shown in the calculator are gross returns.

Equity Funds:

- Short Term (< 1 year): Flat 20% tax on gains.

- Long Term (> 1 year): 12.5% tax on gains exceeding ₹1.25 Lakhs in a financial year.

Debt Funds:

Returns are added to your annual income and taxed according to your Income Tax Slab (Marginal Rate).

Fixed Deposits:

Interest is fully taxable as per your tax slab.

Benefits of Lumpsum Investing

Why should you consider locking your money away?

- nstant Compounding: Unlike SIPs, where the last instalment only compounds for a month, your entire lumpsum compounds for the full tenure.

- Convenience: It is a “fill it, shut it, forget it” approach. You do not need to worry about maintaining a monthly bank balance for auto-debits.

- Financial Discipline: Investing a bonus prevents you from spending it on impulsive lifestyle purchases (like a new phone or car) that depreciate.

- Goal Achievement: A single strategic investment today can fully fund a future goal, such as a child’s education or marriage, without requiring further contributions.

Frequently Asked Questions (FAQs)

Market timing is tricky. Generally, if the market has corrected (fallen) significantly, it is a great time for lumpsum. If the market is at an all-time high, you might prefer an STP. However, if your horizon is >10 years, today is always a good time.

Most mutual funds in India allow a minimum one-time investment of ₹5,000, although some funds allow as little as ₹1,000.

n open-ended mutual funds, yes. However, check for an “Exit Load” (usually 1%) if you withdraw within the first year.

No calculator can predict the future. Our tool provides an estimation based on the rate of return you input. Actual market performance will vary.

If you prefer monthly investments, please navigate to our SIP Calculator to get accurate projections for that investment style.

Conclusion

Wealth is not created by earning money; it is created by making your money work for you. A lumpsum investment is one of the most effective ways to accelerate your journey to financial freedom.

Don’t let inflation erode your hard-earned capital. Use the CalculatorAll.in Lumpsum Calculator above to analyze your potential returns, plan your tenure, and make an informed decision today.

Scroll up, input your investment amount, and visualise your future wealth now!

Try Related Calculator – SIP Calculator