NPS Calculator

Total Invested

Total Interest

Maturity Corpus

Monthly Pension

Yearly Breakdown

| Age | Year | Invested | Interest Earned | Closing Balance |

|---|

NPS Calculator: Secure Your Retirement with the National Pension System

Retirement planning is not just about saving money; it is about ensuring financial independence when the regular paycheck stops. In India, one of the most effective tools for building a retirement corpus is the National Pension System (NPS).

Welcome to CalculatorAll.in. Our Advanced NPS Calculator is designed to help you navigate the complexities of pension planning. Whether you are a government employee, a corporate professional, or a self-employed individual, our tool provides a clear picture of your future wealth, lump sum withdrawals, and monthly pension payouts.

What is the National Pension System (NPS)?

The National Pension System (NPS) is a voluntary, long-term retirement savings scheme designed to enable systematic savings. It is regulated by the PFRDA (Pension Fund Regulatory and Development Authority).

Unlike the Public Provident Fund (PPF) or Fixed Deposits, NPS is a market-linked product. This means your money is invested in a mix of Equity (Stocks), Corporate Bonds, and Government Securities. Historically, this asset allocation has allowed NPS to generate higher returns (typically 9% to 12%) compared to traditional saving instruments, making it a favorite for wealth creation.

Why Use an NPS Calculator?

Calculating NPS returns manually is difficult because it involves compound interest, varying asset allocations, and the specific 60:40 withdrawal rule at maturity. The CalculatorAll.in NPS Calculator simplifies this. It helps you determine:

- Total Corpus: The total money accumulated by age 60.

- Lump Sum Amount: The cash you can withdraw tax-free.

- Monthly Pension: The regular income you will receive from the annuity.

How to Use the Advanced NPS Calculator

Our tool is designed for precision. Here is a step-by-step guide to using the inputs on CalculatorAll.in:

1. Monthly Investment

Enter the amount you can contribute to your NPS Tier-1 account every month. Consistency is key here.

2. Expected Return (ROI)

Since NPS invests in markets, returns vary.

- Conservative (High Debt): 8% – 9%

- Moderate (Balanced): 9% – 10%

- Aggressive (High Equity): 10% – 12%

3. Your Age Details

- Current Age: The age at which you are starting the investment.

- Retirement Age: usually 60 years, but you can extend investment up to 75 years in NPS.

4. Annuity Preferences (The Advanced Part)

NPS rules state you must use at least 40% of your maturity corpus to buy an annuity (which gives you a pension).

- % to Buy Annuity: You can choose to reinvest anywhere from 40% to 100% of your corpus.

- Expected Annuity Rate: This is the interest rate the insurance company pays on your pension pot (typically 6% – 7%).

Once you input these figures, our calculator instantly generates a Doughnut Chart and a Yearly Breakdown Table, showing exactly how your money grows over the years.

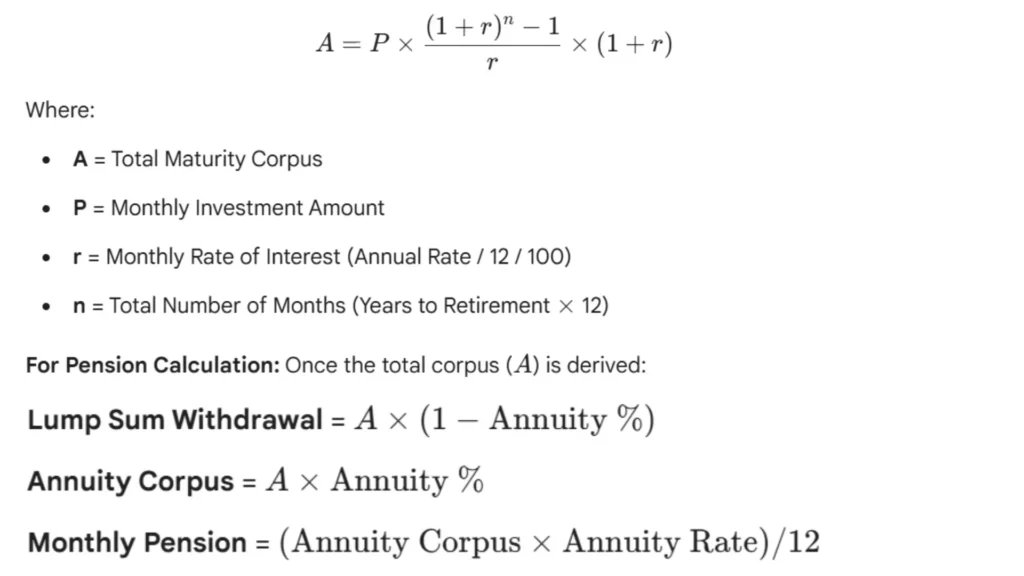

The NPS Calculation Formula

How does the magic happen? The NPS calculator uses the standard formula for the geometric progression of compound interest.

See the formula to calculate the deposited amount in the image below:

Real-Life NPS Investment Examples

To understand the power of starting early, let’s compare two investors using our calculator.

Scenario A: The Early Bird (Starts at 25)

Rahul is 25 years old. He invests ₹5,000/month until age 60. He expects a 10% return.

- Total Invested: ₹21 Lakhs

- Total Corpus: ₹1.91 Crores

- Monthly Pension: ~₹38,000 (at 40% annuity share)

Scenario B: The Late Bloomer (Starts at 35)

Vikram waits 10 years. He starts at 35 and invests double (₹10,000/month) to catch up. He also expects a 10% return.

- Total Invested: ₹30 Lakhs

- Total Corpus: ₹1.33 Crores

- Monthly Pension: ~₹26,000

The Insight: Even though Vikram invested more money (₹30L vs ₹21L), Rahul ended up with significantly more wealth. This proves that in NPS, time in the market beats timing the market. Use the CalculatorAll.in tool to see how much delay is costing you.

NPS Tax Benefits (2025 Update)

NPS is one of the most tax-efficient instruments in India. Here is why tax-savvy investors love it:

1. Section 80C

You can claim a tax deduction of up to ₹1.5 Lakhs per year for NPS contributions under Section 80C (shared with PPF, ELSS, etc.).

2. Section 80CCD(1B) – The Exclusive Benefit

This is the game-changer. You can claim an additional ₹50,000 deduction exclusively for NPS. This is over and above the ₹1.5 Lakh limit, allowing a total deduction of ₹2 Lakhs.

3. Tax on Withdrawal (E-E-E Status Check)

- Lump Sum (60%): This withdrawal is completely Tax-Free.

- Annuity (40%): The amount used to buy an annuity is tax-free, but the monthly pension you receive is taxable as per your income slab.

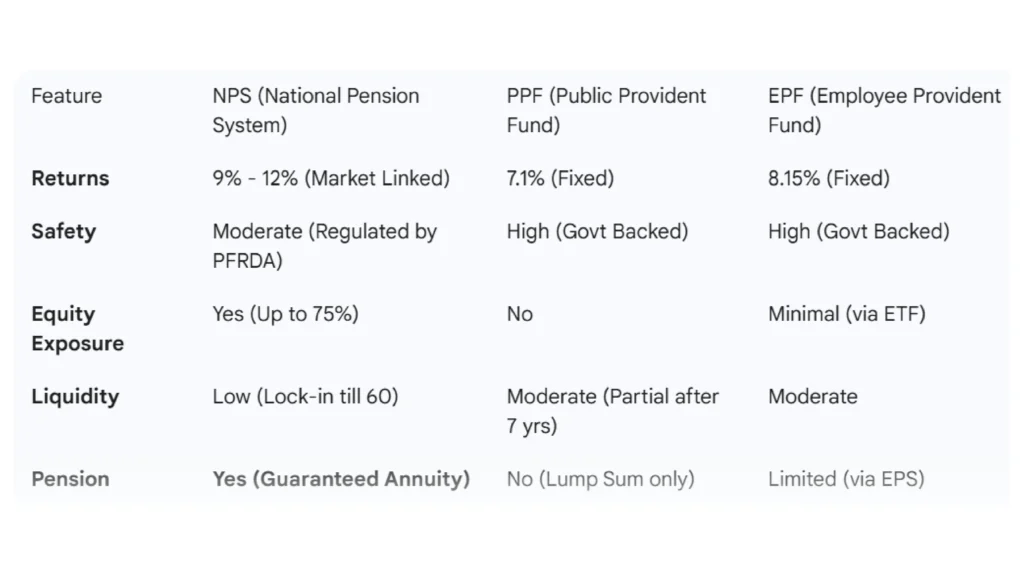

NPS vs. PPF vs. EPF: A Quick Comparison

How does NPS compare to other retirement tools? See the image below:

If you prefer guaranteed, risk-free returns, check our PPF Calculator. However, for beating inflation over 20-30 years, NPS is statistically superior.

Understanding Asset Classes in NPS

When you invest in NPS, your money is divided into four asset classes. You can choose your own split (Active Choice) or let the system decide based on age (Auto Choice).

- Asset Class E (Equity): Invests in stocks. High risk, high reward. (Max 75% allocation).

- Asset Class C (Corporate Bonds): Invests in debt issued by companies. Moderate risk.

- Asset Class G (Government Securities): Invests in Govt bonds. Low risk.

- Asset Class A (Alternative Assets): Invests in REITS/AIFs. (Max 5% allocation).

Our calculator assumes a blended rate of return (ROI). If you have a high equity exposure (75%), you might enter 12% ROI. If you are conservative, enter 8-9%.

Frequently Asked Questions (FAQs)

No. You can withdraw a maximum of 60% of the corpus as a tax-free lump sum. The remaining 40% must be mandatorily utilised to purchase an annuity plan for a monthly pension. If the total corpus is less than ₹5 Lakhs, you can withdraw 100%.

No. The lump sum withdrawal is tax-free, but the monthly pension you receive is treated as “Salary/Income” and taxed according to your income tax slab.

Any Indian citizen (Resident or NRI) between the ages of 18 and 70 can open an NPS account.

The minimum contribution is ₹500 per transaction and ₹1,000 per year to keep the Tier-1 account active.

The CalculatorAll.in NPS Calculator is mathematically precise based on the inputs provided. However, since NPS is market-linked, the actual maturity value will depend on the performance of the Equity and Debt markets over your tenure.

Try Other Useful Calculators – SIP Calculator