RD Calculator

Maturity Summary

Yearly Growth Breakdown

| Year | Invested | Interest | Balance |

|---|

Free RD Calculator: Check Recurring Deposit Maturity & Interest Online

Saving money is not just about setting cash aside; it is about making that cash work for you. In India, one of the most trusted and disciplined ways to build wealth is through a Recurring Deposit (RD). But how do you know exactly how much your small monthly savings will amount to after 5 or 10 years?

This is where the CalculatorAll.in the Advanced RD Calculator steps in.

Whether you are a student saving pocket money, a professional planning a vacation, or a parent building a corpus for your child’s education, our tool eliminates the guesswork. With features like variable compounding frequencies and a detailed yearly breakdown, you can plan your investments with banking-level precision.

What is a Recurring Deposit (RD)?

A Recurring Deposit (RD) is a special type of term deposit offered by banks and Post Offices. Unlike a Fixed Deposit (FD) where you invest a lump sum once, an RD allows you to deposit a fixed amount every month for a pre-determined tenure.

Think of it as a forced savings habit that earns you interest.

- Safety: It is considered a low-risk investment.

- Returns: RDs typically offer interest rates similar to FDs, often higher than standard savings accounts.

- Flexibility: You can start with as little as ₹500 per month.

However, calculating the maturity amount of an RD is tricky because interest is calculated on the reducing balance or accumulated principal every quarter. Manual calculation is nearly impossible for the average person.

How to Use Our Advanced RD Calculator

We have built the CalculatorAll.in the RD Tool, to be the most user-friendly interface on the web. It mimics the actual calculation methods used by top Indian banks like SBI, HDFC, and ICICI.

Follow these simple steps to visualise your wealth:

- Enter Monthly Deposit: Input the amount you can comfortably save each month (e.g., ₹5,000). Use the slider to adjust figures instantly.

- Set Interest Rate: Enter the annual interest rate offered by your bank or Post Office (e.g., 7.5% or 6.8%).

- Choose Tenure: Select how many years you want to keep investing.

- Select Compounding Frequency (Exclusive Feature):

- Most online calculators assume quarterly compounding.

- Our Tool lets you choose between Monthly, Quarterly, Half-Yearly, or Annual compounding. This is crucial because Post Office RDs and Bank RDs often compound differently.

- Analyse the Results: Instantly view your Maturity Amount, Total Investment, and the Wealth Gained (Interest).

The RD Calculation Formula Explained

Why does a ₹5,000 monthly deposit turn into lakhs over a few years? The magic lies in the Compound Interest formula applied to every single instalment.

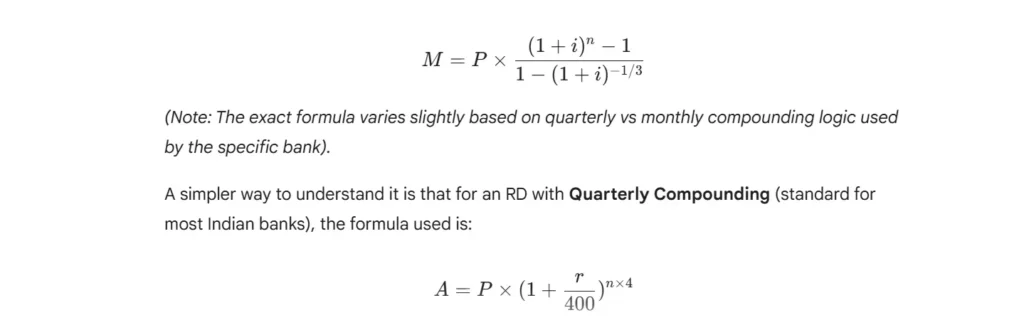

The formula for Recurring Deposit maturity is complex because it uses the Geometric Progression summation. See image below:

However, since you make deposits every month, this formula has to be applied individually to the first deposit (for 12 months), the second deposit (for 11 months), and so on.

Why use our calculator? Doing this calculation manually for a 5-year tenure means calculating interest 60 times and adding it up! Our calculator performs this iteration in milliseconds to give you the exact maturity figure.

Real-World Examples: The Power of Consistency

Let’s compare two scenarios to show why starting early and choosing the right tenure matter.

Scenario 1: The Short-Term Saver

Anjali wants to buy a laptop. She saves ₹2,000 per month for 2 Years at 6.5% interest.

- Total Invested: ₹48,000

- Interest Earned: ₹3,339

- Maturity Value: ₹51,339

- Result: Good for short-term goals, but the interest earned is modest.

Scenario 2: The Long-Term Wealth Builder

Rahul is saving for a down payment on a car. He invests ₹10,000 per month for 5 Years at 7.5% interest (Quarterly Compounding).

- Total Invested: ₹6,00,000

- Interest Earned: ₹1,28,477

- Maturity Value: ₹7,28,477

- Result: By staying consistent, Rahul earned over ₹1.2 Lakhs in pure interest!

You can replicate Rahul’s success by plugging these numbers into the CalculatorAll.in the RD Calculator above.

Factors Affecting Your RD Returns

To maximize your returns, you must understand the three levers that control your RD maturity value.

1. Compounding Frequency

This is the hidden secret of banking.

- Quarterly Compounding: (Standard for banks) Interest is added to your principal every 3 months.

- Monthly Compounding: Interest is added every month. This yields higher returns than quarterly compounding.

- Feature Alert: Use the dropdown in our tool to switch between “Quarterly” and “Monthly” to see the difference in returns for the exact same deposit amount.

2. Interest Rate & Senior Citizen Benefits

Banks typically offer 0.50% extra interest to Senior Citizens. Always ensure you check the “Senior Citizen” slab if opening an RD for your parents. A 0.5% difference can add thousands to the final maturity amount over 10 years.

3. TDS (Tax Deducted at Source)

Remember, the interest earned on RDs is taxable. If your interest income exceeds ₹40,000 (or ₹50,000 for seniors) in a financial year, banks will deduct TDS at 10%. Our calculator shows the gross maturity amount before tax.

RD vs. SIP: Which is Better?

A common question we get is: “Should I start an RD or a SIP in Mutual Funds?” See image below:

Verdict: If you cannot afford to lose a single rupee of your principal, stick to an RD. Use our calculator to plan safe, guaranteed goals.

Frequently Asked Questions (FAQ)

Usually, no. Standard Bank RDs require a fixed monthly amount. However, some banks offer “Flexi RDs” where you can deposit variable amounts.

Banks typically charge a penalty (around ₹1.50 per ₹100) for delayed payments. Frequent defaults might lead to the closure of the RD account.

Post Office RDs are sovereign-backed (100% safe) and often offer slightly better interest rates than large private banks. However, they usually have a fixed 5-year lock-in period, whereas bank RDs can be as short as 6 months.

The interest earned is added to your total annual income and taxed according to your Income Tax Slab.

Start Building Your Corpus Today

The journey of a thousand miles begins with a single step—or in this case, a single monthly deposit. Don’t let your money sit idle in a savings account.

Scroll up to the CalculatorAll.in the Advanced RD Calculator, input your savings target, and watch how small, disciplined investments can turn into a massive financial safety net.

Plan. Save. Grow.

Try Other Useful Calculators – FD Calculator