SIP Calculator

Invested Amount

Est. Returns

Maturity Value

Absolute Return

Yearly Breakdown

| Year | Invested Amount | Interest Earned | Maturity Value |

|---|

SIP Calculator: The Ultimate Tool to Plan Your Financial Freedom

In the world of personal finance, consistency is the key to wealth. Whether you are saving for a dream home, your child’s education, or a comfortable retirement, waiting for a “lucky break” is not a strategy—planning is.

Welcome to CalculatorAll.in, where we simplify your journey to wealth creation. Our advanced SIP Calculator is designed to help you visualise the magic of compounding. By investing small amounts regularly, you can build a massive corpus over time, and our tool shows you exactly how.

What is a SIP Calculator?

A SIP (Systematic Investment Plan) Calculator is a powerful online simulation tool that helps investors estimate the returns on their mutual fund investments. It eliminates manual calculations and complex spreadsheets, giving you an instant snapshot of your future wealth based on three simple inputs:

- How much do you invest monthly?

- Your expected rate of return.

- The duration of your investment.

Unlike standard calculators, the CalculatorAll.in SIP Calculator comes with an advanced “Step-Up” feature. This allows you to account for yearly increases in your salary or income, giving you a much more realistic picture of your financial future.

How to Use Our Advanced SIP Calculator

Using our tool is intuitive and fast. Follow these steps to generate your personalized wealth report:

1. Enter Monthly Investment

Input the amount you can comfortably set aside every month. It could be as little as ₹500 or as much as ₹1 Lakh.

2. Set Expected Return Rate

Enter the annual rate of return you expect.

- Equity Funds: Typically 12% – 15% (Long term)

- Hybrid Funds: Typically 9% – 11%

- Debt Funds: Typically 6% – 8%

3. Choose Time Period

Select the number of years you plan to stay invested. Remember, in the world of SIPs, time is more important than timing.

4. Adjust Annual Step-Up (Pro Feature)

This is where our tool shines. If you plan to increase your SIP amount by, say, 10% every year as your salary grows, use the Annual Step-Up slider. This small adjustment can drastically change your final maturity value.

Once entered, you will see an interactive doughnut chart comparing your total investment against your pure profit, along with a detailed yearly breakdown table.

How Does a SIP Work? (The Power of Compounding)

SIP works on two fundamental principles: Compounding and Rupee Cost Averaging.

The Magic of Compounding

Albert Einstein famously called compounding the “eighth wonder of the world.” In an SIP, you earn returns not just on your principal amount, but also on the returns generated by that principal. Over 10 or 20 years, the “interest on interest” component often exceeds the actual money you invested.

Rupee Cost Averaging

Market volatility often scares new investors. SIP solves this. When the market is down, your fixed monthly amount buys more units. When the market is up, it buys fewer units. Over time, this averages out the cost of purchase, protecting you from the risk of timing the market incorrectly.

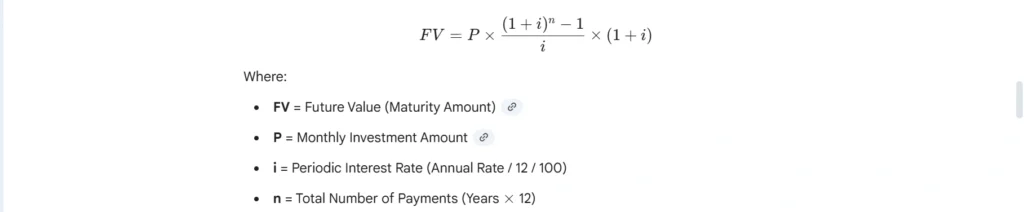

SIP Calculator Formula: The Math Behind the Millions

Want to know how the numbers are calculated? Check out the formula our SIP calculator uses to calculate expected returns in this image:

Note: This formula calculates the maturity value assuming the investment is made at the beginning of each period.

Real-Life Examples: SIP vs. Step-Up SIP

To understand why the Step-Up feature on CalculatorAll.in is so vital, let’s compare two investors, Ravi and Priya.

Scenario A: Standard SIP (Ravi)

Ravi starts a SIP of ₹10,000/month for 20 years at 12% return.

- Total Invested: ₹24 Lakhs

- Maturity Value: ₹99.9 Lakhs

- Verdict: Ravi creates impressive wealth, nearly touching ₹1 Crore.

Scenario B: Step-Up SIP (Priya)

Priya also starts with ₹10,000/month for 20 years at 12%. However, she decides to increase her SIP amount by just 10% annually (Step-Up).

- Total Invested: ₹68.7 Lakhs

- Maturity Value: ₹2.07 Crores

- Verdict: By simply increasing her investment slightly each year, Priya doubles her wealth compared to Ravi.

Use our calculator to toggle the Step-Up percentage and see the difference for yourself!

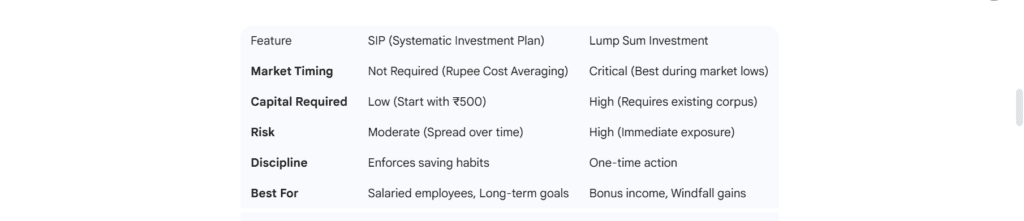

SIP vs. Lump Sum: Which is Better?

We are often asked whether to invest a large sum at one go (Lump Sum) or invest small amounts regularly (SIP). Understand this through this image.

Conclusion: For most salaried individuals, SIP is the safer and more disciplined route to creating wealth.

Key Benefits of Investing via SIP

- Financial Discipline: The money is deducted automatically from your bank account, ensuring you save before you spend.

- Flexibility: You can stop, pause, or increase your SIP anytime. There are no penalties for stopping (unlike insurance policies).

- Power of Small Starts: You do not need to be rich to invest. You can start building a corpus for the price of two movie tickets.

- Inflation Beating: Unlike savings accounts (3-4% return), equity SIPs (12-15% return) historically beat inflation, preserving your purchasing power.

axation on SIP Returns (2025 Update)

When using the SIP Calculator, remember that the final amount shown is the gross maturity value. The actual “in-hand” amount will depend on taxation.

Equity Mutual Funds ( > 65% in stocks):

- LTCG (Long Term Capital Gains): If sold after 1 year, gains above ₹1.25 Lakh per year are taxed at 12.5%.

- STCG (Short Term Capital Gains): If sold before 1 year, gains are taxed at 20%.

Debt Mutual Funds:

- Gains are added to your income and taxed as per your income tax slab.

Tax rules change periodically. Always consult a tax professional for the latest advice.

Frequently Asked Questions (FAQs)

Our calculator uses the standard compound interest formula used by all financial institutions. However, actual returns depend on market performance. Use these figures as an estimation, not a guarantee.

Yes, mutual funds are subject to market risks. However, over long periods (5-10+ years), the probability of negative returns in diversified equity funds significantly decreases.

There is no “lucky date.” Whether you choose the 1st or the 25th of the month, the difference in returns over 10 years is negligible. Choose a date shortly after your salary credit day to ensure the balance is available.

A common rule is the 50-30-20 rule. 20% of your monthly income should ideally go towards savings and investments like SIPs.

This specific tool is optimized for monthly inputs. For one-time investments, please navigate to our dedicated Lumpsum Calculator page.

Start Your Wealth Journey Today

The best time to plant a tree was 20 years ago. The second-best time is now.

The SIP Calculator on CalculatorAll.in is more than just a tool; it is your roadmap to financial independence. By visualising your goals, you are more likely to achieve them. Don’t let your money sit idle in a savings account, losing value to inflation.

Scroll up, input your numbers, and take the first step towards a wealthier tomorrow!