Stock Average Calculator

Total Units

Total Invested

New Average

Portfolio Breakdown

| Order # | Price | Units | Total |

|---|

Stock Average Calculator: Calculate Share Average Price Instantly

Every investor in the Indian stock market knows the feeling: you bought a stock, the price dipped, and now you want to buy more to lower your overall cost. But at what price will you break even? That is exactly where a stock average calculator becomes your best friend.

Whether you are a seasoned trader on the NSE or a beginner on the BSE, knowing your exact average price is crucial for making profitable exit decisions. Our advanced tool simplifies this process, helping you perform a precise stock average calculation in seconds without complex spreadsheets.

What Is a Stock Average Calculator?

A stock average calculator is an essential online tool designed for traders and investors to determine the average price of a stock when multiple quantities are purchased at different rates. Instead of manually juggling numbers, this tool gives you a single, weighted average price for your entire holding.

Meaning of Stock Average Price in the Share Market

In the share market, the “average price” is the weighted mean cost of all the shares you currently hold. It is not just the simple average of the buying prices; it accounts for the quantity bought at each price level. This figure represents your true break-even point.

What Is Averaging in Stock Trading?

Averaging is a strategy where an investor buys more shares of a stock they already own at a different price.

- Averaging Down: Buying more when the price falls to lower your average cost.

- Averaging Up: Buying more when the price rises to accumulate a winning stock. Most Indian investors use stock averaging to recover from loss-making positions by bringing the average cost closer to the current market price.

Why the Stock Average Calculation Is Important for Investors

Accurate calculation is the backbone of portfolio management. If you don’t know your exact average, you might sell a stock thinking you made a profit, only to realize later that you actually made a loss after factoring in the higher cost of earlier expensive purchases. A share average calculator eliminates this risk.

How a Stock Average Calculator Works

The calculator operates on a simple principle of weighted averages. It takes into account both the volume of shares and the price per share for every single transaction.

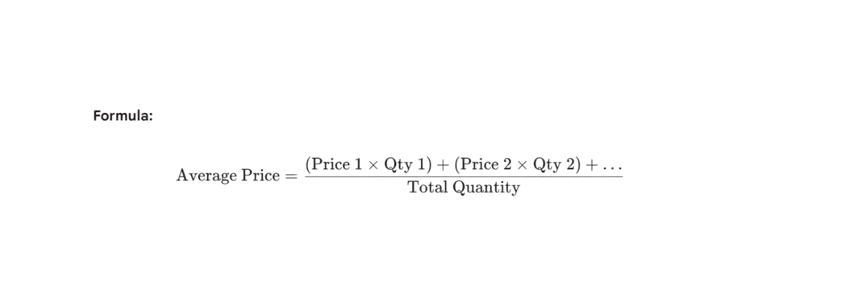

Stock Average Formula Explained Simply

The math behind the tool is straightforward, but it can get tedious with multiple entries. See the formula in the image below:

This stock average formula ensures that a purchase of 100 shares has a greater impact on the average than a purchase of 10 shares.

Inputs Required for Stock Average Calculator

To get your result, you need:

- Buy Price: The rate at which you bought the shares.

- Quantity: The number of shares purchased at that rate. Our calculator allows you to add multiple rows for different purchase dates.

How Quantity and Price Affect Average Cost

Quantity acts as a “weight.” If you buy 10 shares at ₹100 and 1000 shares at ₹50, your average will be very close to ₹50, not ₹75. Understanding this relationship helps you plan how much capital is needed to bring your average down significantly.

Benefits of Using a Stock Average Calculator Online

Why switch to an online tool? Here is why smart investors prefer it.

Accurate Stock Average Price Calculation

Human error is common when dealing with decimals and large numbers. Our tool guarantees 100% precision in your average share price calculation, ensuring your profit targets are based on real data.

Saves Time Compared to Manual Calculation

Imagine having bought Tata Motors or Reliance shares in 5 different tranches over 2 years. Calculating the average manually would take 10 minutes. Our calculator does it in 10 milliseconds.

Best Tool for Indian Stock Market Investors

Designed specifically for the Indian context, this tool is perfect for verifying the “average price” shown by your broker (like Zerodha, Upstox, or Groww), ensuring there are no discrepancies.

Helps in Better Buy and Sell Decisions

Before you buy the dip, use the calculator to simulate the outcome. “If I buy 50 more shares now, what will my new price be?” Knowing this helps you decide if the investment is worth the risk.

How to Calculate Stock Average Price Manually

If you ever need to do this on a napkin, here is how.

Stock Average Calculation Step by Step

- Multiply the Price by the Quantity for the first purchase to get the Total Amount.

- Do the same for the second (and subsequent) purchases.

- Add up all the Total Amounts to get the Total Invested Value.

- Add up all the Quantities to get the Total Shares.

- Divide Total Invested Value by Total Shares.

Share Average Formula with Example

- Buy 1: 10 shares at ₹200 (Total = ₹2,000)

- Buy 2: 20 shares at ₹100 (Total = ₹2,000)

- Total Cost: ₹4,000

- Total Shares: 30

- Average: 4000 / 30 = ₹133.33

Common Mistakes While Calculating Stock Average

The biggest mistake is taking a simple average of prices (e.g., (200+100)/2 = 150). This is wrong because it ignores the quantity. Always use the weighted average method.

Stock Average Calculator with Example

Let’s visualise this with a real-world stock average calculator example.

Stock Average Calculator Example with Multiple Buys

Suppose you are accumulating shares of ITC.

- Tranche 1: 50 shares @ ₹400

- Tranche 2: 30 shares @ ₹380

- ranche 3: 100 shares @ ₹350. Entering these into the calculator instantly tells you the consolidated price required to be in the green.

Share Average Price Calculation Example

Using the data above:

- Total Invested = (50400) + (30380) + (100*350) = 20,000 + 11,400 + 35,000 = ₹66,400.

- Total Shares = 50 + 30 + 100 = 180.

- Final Average Price = ₹368.88.

Stock Averaging Example for Beginners

If you are a beginner holding 10 shares of a company at ₹1000 and the price crashes to ₹500, buying just 10 more shares at ₹500 brings your average down drastically to ₹750. This is the power of averaging.

Stock Averaging Strategy Explained

Knowing the math is one thing; understanding the strategy is another.

What Is Stock Averaging Strategy?

A stock averaging strategy involves systematically buying shares at different price points to smooth out market volatility. It is the core principle behind SIPs (Systematic Investment Plans).

When to Do Averaging in Stocks

Good Fundamentals: Only average down if the company is fundamentally strong (e.g., blue-chip stocks like HDFC Bank or Infosys).

Panic Selling: Averaging is most effective during market corrections when fear drives prices below intrinsic value.

Is Averaging Down a Good Strategy in India?

Yes, but with caution. “Catching a falling knife” (averaging in a bad company that keeps falling) can destroy wealth. Use the calculator to ensure you aren’t throwing good money after bad, and ideally, averaging works best for long-term investors in the NSE/BSE.

Stock Average Calculator for the Indian Stock Market

Stock Average Calculator for NSE and BSE

Our tool works perfectly for all stocks listed on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), handling prices with Indian decimals effortlessly.

Stock Average Calculator for Delivery Trading

For delivery (holding stocks for more than one day), accurate averaging is vital because you might hold these positions for years.

Stock Average Calculator for Intraday Trading

Even intraday traders use this. If you are scalping and building a position in multiple legs, knowing your average price helps you set a precise stop-loss and target for the day.

Stock Average Calculator vs Manual Calculation

Why the Online Stock Average Calculator Is Better

It is faster, error-free, and accessible on your mobile. You can modify inputs dynamically—”What if I buy at ₹90 instead of ₹95?”—and see instant results.

Accuracy Comparison: Calculator vs Manual Method

Manual calculation is prone to “fat-finger” errors. A calculator uses precise algorithms, ensuring your financial planning is based on hard facts.

Best Free Stock Average Calculator in India

We offer the most user-friendly interface with no hidden charges. It is built for the Indian investor who values speed and accuracy.

Stock Average Calculator FAQs

You calculate it by dividing the total capital invested by the total number of shares held.

Absolutely. If you do a monthly SIP in a stock (like buying 5 shares of Reliance every month), this tool is perfect for finding your annual average cost.

Yes, averaging is a proven method to reduce risk over the long term, provided you are investing in quality companies.

Yes, it works for large-cap, mid-cap, small-cap, and even penny stocks

Why Use Our Free Stock Average Calculator?

Instant and Accurate Stock Average Results

Get precise results in milliseconds. No waiting, no complex sign-ups.

Easy-to-Use Stock Average Calculator Online

Our clean interface ensures that anyone, from a college student to a retired pensioner, can use the tool without confusion.

Free Stock Average Calculator for Indian Investors

We believe financial tools should be accessible to all. Use our stock average calculator India tool as many times as you want, completely free.

Ready to optimise your portfolio? Scroll up and use the calculator to find your perfect average price now.

Try SIP Calculator