SWP Calculator

Invested

Withdrawn

Interest

Final Value

Yearly Breakdown

| Year | Balance (End of Year) | Total Withdrawn | Interest Earned |

|---|

SWP Calculator: Master Your Monthly Income & Retirement Planning

Are you looking for a reliable way to generate a steady monthly income from your investments? Whether you are planning for a comfortable retirement or seeking a secondary income source, a Systematic Withdrawal Plan (SWP) is one of the most powerful financial tools available.

Welcome to CalculatorAll.in, home to the most advanced SWP Calculator on the web. In this comprehensive guide, we will explain how SWP works, the formula behind the math, and how you can use our tool to secure your financial future.

What is a Systematic Withdrawal Plan (SWP)?

Before diving into the numbers, it is essential to understand the concept. A Systematic Withdrawal Plan (SWP) is a facility provided by mutual funds that allows investors to withdraw a specific sum of money from their fund investment at regular intervals (usually monthly).

Think of an SWP as the exact opposite of an SIP (Systematic Investment Plan). While an SIP helps you accumulate wealth by depositing small amounts regularly, an SWP helps you utilize that wealth by withdrawing small amounts regularly

Why is SWP Popular?

- Regular Income: It creates a steady cash flow akin to a salary or pension.

- Capital Growth: While you withdraw a portion, the remaining money stays invested and continues to generate returns.

- Tax Efficiency: SWP is often more tax-efficient than traditional Fixed Deposits (FDs) or Dividend plans.

How to Use the SWP Calculator on CalculatorAll.in

Our SWP Calculator is designed for precision and ease of use. It helps you visualize how long your corpus will last and how much interest you will earn over time. Here is a step-by-step guide to using the tool above:

1. Enter Your Total Investment

Input the total lump sum amount you plan to invest in a Mutual Fund or have already accumulated. For example, if you are retiring with a corpus of ₹50 Lakhs, enter 50,00,000.

2. Set Your Expected Annual Return

Enter the expected rate of return from your mutual fund scheme. Equity funds generally offer 10-12% over the long term, while Hybrid or Debt funds might offer 7-9%.

3 . Decide Your Monthly Withdrawal

How much money do you need every month? Enter your desired withdrawal amount. Be realistic—if you withdraw too much too fast, your capital may deplete early.

4. Choose the Duration

Select the time period for which you wish to run the SWP. This could be 10 years, 20 years, or even 30 years for retirement planning.

Once you input these details, our SWP Calculator immediately generates a dynamic pie chart showing your total investment versus total interest earned, along with a detailed yearly breakdown table.

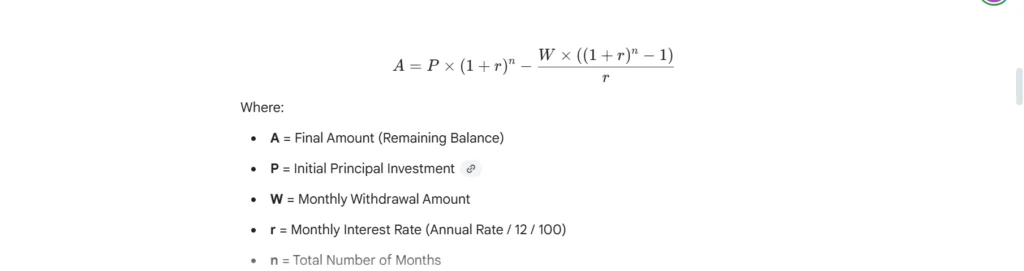

The SWP Formula: How the Math Works

Many investors ask, “How is SWP calculated?” While our calculator handles the complex iterations instantly, understanding the logic is helpful.

The calculation of SWP is based on the concept of reducing balance. Every month, your withdrawal amount is deducted from the investment balance, while the remaining balance continues to earn interest.

Mathematical Logic

Illustrate the generic formula for calculating the final balance after a specific number of months using this image:

Note: This formula assumes withdrawals happen at the end of the month. In reality, mutual fund units are redeemed based on the Net Asset Value (NAV) on the date of withdrawal. Our calculator on CalculatorAll.in simulates this month-on-month reduction to give you the most accurate projection.

Real-Life SWP Examples

To better understand how an SWP can secure your lifestyle, let’s look at two common scenarios.

Scenario 1: The Smart Retiree

Mr. Sharma retires with a corpus of ₹50 Lakhs. He invests this in a Hybrid Mutual Fund with a conservative expected return of 9% per annum. He wants a monthly pension of ₹35,000 for 20 years.

Investment: ₹50,00,000

Withdrawal: ₹35,000/month

Duration: 20 Years

Result: According to our SWP Calculator, Mr. Sharma will withdraw a total of ₹84 Lakhs over 20 years. Amazingly, because his return rate (9%) is healthy, he will still have a significant balance left at the end of the tenure.

Scenario 2: The Aggressive Withdrawal (Risk Warning)

Scenario 2: The Aggressive Withdrawal (Risk Warning)

If Mr. Sharma decides to withdraw ₹50,000 monthly from the same ₹50 Lakh corpus, the calculator might show a warning. With higher withdrawals, the corpus may deplete early, leaving him with zero balance before the 20-year term ends.

This illustrates why using the CalculatorAll.in SWP tool is vital—it helps you find the “safe zone” for withdrawals.

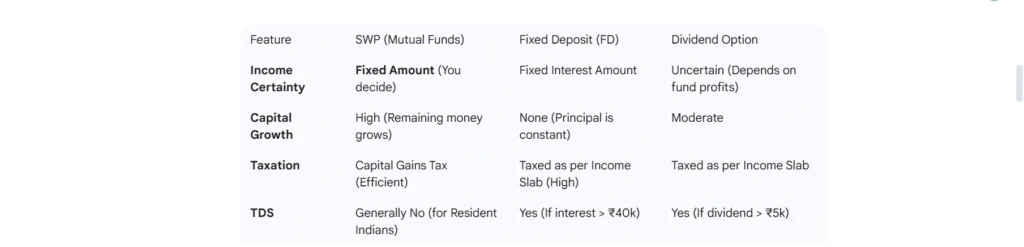

SWP vs. Fixed Deposit (FD) vs. Dividend Options

Why should you choose SWP over traditional bank fixed deposits or dividend options in mutual funds? See the comparison in this image:

Key Takeaway: SWP is generally more tax-efficient. In an FD, the entire interest is taxed. In an SWP, only the capital gains portion of your withdrawal is taxed, and the principal component is tax-free.

Tax Implications of SWP in India (2025 Update)

When using a SWP calculator, it is crucial to consider taxation to understand your “in-hand” income. SWP withdrawals are treated as redemptions.

1. Equity Mutual Funds (holding > 65% equity)

- Short Term ( < 1 year): Taxed at 20% (STCG).

- Long Term ( > 1 year): Taxed at 12.5% (LTCG) on gains exceeding ₹1.25 Lakh in a financial year.

2. Debt Mutual Funds

As per recent finance amendments, gains from Debt Mutual Funds are typically added to your taxable income and taxed according to your income tax slab, regardless of the holding period (for funds acquired after April 1, 2023).

Note: Tax laws are subject to change. Always consult a CA for exact figures.

Strategies to Maximize Your SWP

To get the most out of the CalculatorAll.in tool and your investments, follow these pro strategies:

The "6% Rule."

A common rule of thumb in the financial world is to keep your annual withdrawal rate below 6% of your total corpus. If you withdraw 6% or less annually, your capital will likely last indefinitely (assuming returns of 8-10%).

- Example: On ₹1 Crore, withdraw ₹50,000/month (₹6 Lakhs/year).

Inflation Adjustment

Standard SWP plans offer a fixed amount. However, expenses rise with inflation. You can use our calculator to test higher withdrawal amounts for future years to see if your corpus can support increasing needs.

Bucket Strategy

Divide your investment into buckets. Keep 3 years’ worth of withdrawals in safer Debt funds (low risk) and the rest in Hybrid or Equity funds (high growth). This protects your monthly income from stock market crashes.

Frequently Asked Questions (FAQs)

Yes. Dividends are declared only when the fund makes a profit, making them unreliable. Furthermore, dividends are now taxable at your slab rate. SWP gives you a fixed inflow and better tax efficiency

Absolutely. SWP is flexible. You can stop, pause, or increase/decrease the withdrawal amount anytime by instructing the Asset Management Company (AMC).

If the market crashes, your fund’s NAV drops. To maintain your fixed withdrawal amount, more units will be sold. This can deplete your capital faster. This is why a conservative withdrawal rate is recommended.

Most mutual funds charge an exit load (usually 1%) if you withdraw within 1 year. Our calculator shows the raw mathematical projection. For the first year, ensure your withdrawals do not exceed the free withdrawal limit of your specific fund.

The CalculatorAll.in SWP tool is mathematically precise based on the inputs provided. However, real-world mutual fund returns fluctuate on a daily basis. Use this tool for estimation and planning, not as a guaranteed prediction.

Conclusion

Planning for financial freedom is not just about saving; it is about withdrawing smartly. A Systematic Withdrawal Plan is the bridge between a lump sum investment and a stress-free monthly lifestyle.

By using the Advanced SWP Calculator on CalculatorAll.in, you can eliminate the guesswork. Whether you want to ensure your retirement corpus outlives you or simply want to generate passive income, our tool provides the clarity you need.

Ready to plan your future? Scroll up, input your numbers, and discover the power of compounding combined with smart withdrawals today!

Check out our SIP Calculator to see how to build this corpus